It is mainly being used for automating repetitive tasks and giving better analytical insights to business leaders.

Top 9 AI-Driven Collection Technologies Powering Effective Debt Recovery

Nine AI-powered data collection tools that improve recovery, reduce risk, and streamline daily tasks are examined in this guide. It lists the essential features, such as automated outreach, self-service portals, lifecycle management, and real-time analytics.

You will see where each product fits, what it does well, and which teams benefit most. Expect concise summaries of features, AI functions, and proven use cases.

The goal is clarity. With consistent data, configurable workflows, and secure integrations, these tools help organizations act faster and measure impact.

Use the comparisons to refine your stack and focus on options that raise collections while protecting customers, and read this blog post thoroughly for a better understanding

Let’s begin!

Key Takeaways

- Understanding C&R software

- Looking at the DebtPack

- Uncovering the key highlights of DebtStream and ACE web debt collection

- Decoding the advanced debt collection of Lariat

C&R Software

C&R Software leads the industry in AI debt collection software. The AI-and cloud-native platform combines real-time analytics with scalable strategies that work across portfolios and geographies. Independent certifications and controls support regulated operations at volume.

Organizations adopt C&R Software to raise recoveries, reduce risk, and align teams around a single source of truth. The company reports deployments across 60+ countries and multiple industries, backed by a mature add-on ecosystem

C&R Software Key Features

- End-to-end lifecycle management across pre-delinquency, collections, recovery, legal, and asset processes in one system of record.

- C&R Software interface shows the right customer and account context at the right time, improving agent efficiency.

- C&R Software lets administrators modify workflows, data, and screens without relying on heavy custom code

C&R Software AI Capabilities

- FitLogic brings a low-code decision engine to orchestrate treatments, eligibility, and job actions across workflows.

- FitComms personalizes timing and channel selection for outreach, raising response and payment rates.

- 24/7 self-service is made possible by Cara AI, allowing users to handle payments and accounts whenever they want.

C&R Software Best Use Case

- Banks, fintechs, and lenders needing centralized collections with configurable strategies and high-volume scale.

- Enterprises replacing fragmented tools with a single system that integrates partners and preserves auditability

Interesting Facts

AI is rapidly integrating into accounting workflows, with 83% of professionals globally using the technology to automate routine tasks, reduce errors, and shift towards more strategic, advisory roles

DebtPack

DebtPack provides practical accounts receivable management for Windows users at an affordable price point.

DebtPack Key Features

DebtPack delivers results through these powerful yet straightforward features:

- Automated communication: Using templates and business rules, the system generates emails and SMS to maximize data collection.

- Adaptable deployment choices: Users can select between installations with internet connectivity for one or more users.

- Modular design – Options range from simple Single User to Multi User Legal versions that include court collection procedures

- Integration capabilities – The software connects to most financial systems through smooth file mapping

- Full audit trails – Every action and communication gets timestamped records that ensure accountability

Users get customized reporting options beyond standard industry reports. Pre-defined templates support both pre-legal notifications and Magistrates’ Court Act compliance. Public sector clients benefit from specialized modules that handle municipal debt collection, indigent management, and credit control.

DebtPack Capabilities

DebtPack excels at automating routine collection tasks in three ways:

To-do lists that are driven by a diary help to ensure that urgent tasks are not overlooked.

Incomplete tasks are forwarded to supervisors by the workflow escalation system according to predetermined deadlines.

Individual case allocation enables workload balancing by distributing accounts evenly or matching case types to staff expertise.

The system calculates aging by period or days for cases and individual invoices. Payment management features track expected payments and payment plans while flagging failures quickly.

DebtPack Best Use Case

These organizations get the most value from DebtPack:

- Small to medium businesses ready to move beyond spreadsheets

- Companies that need complete legal process management through Magistrates’ Court procedures

- Municipal finance departments looking to implement customer-focused debt collection in-house

The program performs best in settings that require unambiguous performance monitoring. With user activity monitoring that logs every action, supervisors are able to precisely set goals and gauge results.

Companies looking for debt collection software with minimal complexity will find that DebtPack delivers core functionality without overwhelming its users. The software groups accounts through batch processing using custom criteria that streamline handling.

DebtStream

DebtStream brings a fresh approach as a digital-first collections platform. The company started in 2018 and launched in March 2020. It provides self-service options that revolutionize customer interactions during financial hardship.

DebtStream Key Features

DebtStream offers a white-label platform that matches your brand identity:

- A complete digital self-service system for collections and recoveries

- Digital communication tools that increase customer involvement through a variety of channels

- You can easily configure code-driven compliance.

- Seamless connections with payment processors and collection platforms

A legal services firm saw their monthly gross collections jump by 20% after they started using DebtStream. The platform really shines during economic downturns. Its launch during COVID showed perfect timing, as the pandemic sped up digital adoption by about five years.

DebtStream Capabilities

DebtStream goes beyond simple collection functions and uses AI to improve recovery operations.

The AI tools include:

- Automated chatbots handle straightforward customer questions, which lets agents focus on complex issues.

- Predictive analytics help identify customers likely to repay, making collection efforts more targeted.

- Pattern recognition algorithms scan large datasets and find trends that human agents might miss.

DebtStream Best Use Case

DebtStream works best for:

- Financial institutions that want to keep good customer relationships during tough times

- Businesses with credit accounts that need modern collection strategies

- Organizations that want supportive digital self-service options

The platform helps companies move away from traditional call centers. Data shows that 75% of customers who tried digital services during the pandemic still use them. DebtStream helps businesses meet this growing demand for digital options.

ACE Web Debt Collection

InterProse’s ACE Web Debt Collection combines cloud convenience with bank-grade security on Amazon AWS servers.

ACE Web Debt Collection Key Features

ACE provides practical answers to everyday collection challenges:

- You can easily manage customer information, account status, and payment scheduling with this full-color, single-window interface.

- ACH, credit cards, and custom payment plans are all handled seamlessly by built-in payment processing.

- Instant access document storage that backs up files to several safe locations

- Monthly software updates bring new features at no extra cost

- Third-party integration connects with skip tracing, dialer, and text messaging services seamlessly

The web-based design removes server management hassles completely. Users can work from any location while meeting strict security requirements.

ACE Web Debt Collection Capabilities

The system’s Virtual Agent Collector sets it apart – a digital assistant that works round the clock at a fraction of human agent costs. This AI helper manages digital communications and stays within regulatory bounds automatically.

Teams work faster and better with the platform’s smooth workflow. The system automates account placement downloads, remittance data uploads, and scheduled report generation.

The cloud-based SQL database with its browser interface simplifies everything from client payments to account management across multiple locations.

ACE Web Debt Collection Best Use Case

ACE Web Debt Collection serves perfectly for:

- Collection agencies that need secure infrastructure without heavy IT spending

- Law firms that handle both legal work and debt collection

- Organizations looking for flexible debt collection software they can use anytime

The platform excels when managing multiple clients at once. Its open design welcomes your preferred third-party services and helps collect debts more efficiently through smart automation.

Amblin Software Debt Collector

Amblin Software’s Debt Collector stands out with its practical approach among specialized debt collection solutions.

Amblin Software Debt Collector Key Features

Amblin Software equips debt recovery operations with practical tools:

- User-friendly interface with simple navigation to access account data quickly

- Customizable debtor profiles to track payment histories and communication

- Automated document generation for legal notices and payment reminders

- Multi-user access controls with different permission levels

- Integrated reporting tools to track performance

The software creates an organized system that keeps collection efforts moving through scheduled follow-ups. Collection teams can stay focused on results thanks to its straightforward design.

Amblin Software Debt Collector AI Capabilities

Amblin’s AI functions make collection processes smoother. The system studies payment patterns to spot accounts that need attention. Based on account history and status, it then recommends the right actions to take.

The platform fine-tunes collection strategies by learning from response rates, which leads to better recovery outcomes. Teams can focus on accounts more likely to pay thanks to its predictive capabilities.

Amblin Software Debt Collector Best Use Case

Amblin Software proves excellent for:

- Small to medium collection agencies that need straightforward management tools

- First-party collectors handling in-house receivables

- Businesses moving from manual to digital collection processes

Amblin gives organizations a straightforward option to handle debt collection software without excess complexity. The software’s value comes from making daily collection tasks simpler while giving full visibility into accounts.

Tesorio

Tesorio provides a compelling alternative as an intelligent AR platform. This platform helps businesses automate their financial operations to free up working capital.

Tesorio Key Features

Tesorio brings together visibility and efficiency through these notable features:

- campaigns to collect money using personalized templates and automated emails

- Tools for applying cash that link invoices and payments

- Portals for consumer payments for self-service options

- Data from real-time AR forecasting

- Portals for suppliers and agent processes

The platform blends with existing systems like ERPs, CRMs, billing platforms, and banking systems to create a unified financial hub.

Tesorio AI Capabilities

Tesorio’s AI tools make collections more efficient:

- The AI Email Assistant combines conversation threads and provides quick account summaries.

- AI Email Summarization pulls out key points from communications so teams can understand situations quickly.

- Promise-to-Pay detection looks through emails for payment commitments and updates records with a single click.

- The platform also analyzes customer sentiment to help teams respond appropriately to each situation.

Tesorio Best Use Case

Tesorio works best for mid-sized to larger businesses with revenue between $10.00M USD- $1.00B USD, especially in software, technology, manufacturing, and services.

Businesses achieve remarkable outcomes: they spend 87% less time on forecasting, increase collections productivity by 300%, and decrease DSO by an average of 33 days.

Organizations that need complete debt collection software with robust AI capabilities will find that Tesorio delivers measurable ROI.

Debt Recovery Manager (DRM)

Debt Recovery Manager (DRM) uses modern technology to make the collections process smoother.

Debt Recovery Manager (DRM) Key Features

DRM stands out with these practical collection tools:

- Centralized account management that tracks debtor profiles and communication history

- Automated reminders via email, SMS, and voice notifications

- Processing payments through a variety of gateways

- Dashboards for real-time data analysis that display the status of collection

- Tools for compliance that uphold legal requirements

The system assigns priority to accounts based on risk profiles and directs resources to the most promising recovery opportunities.

Debt Recovery Manager (DRM) AI Capabilities

DRM uses predictive models to spot at-risk accounts before they become delinquent. The scoring system analyzes payment patterns and creates targeted strategies.

DRM’s AI goes beyond automation and studies consumer behavior to suggest the best communication channels. Some people respond better to emails, others to text messages.

The voice analytics system checks every call and flags potential compliance problems.

Debt Recovery Manager (DRM) Best Use Case

Financial institutions with high-volume portfolios see the best results from DRM. The system’s capacity to handle over USD 8.00 trillion in active accounts makes it perfect for large-scale operations.

DRM helps organizations that require sophisticated debt collection software achieve two important objectives in the current collection environment: increased efficiency and compliance.

Lariat Advanced Debt Collection

Lariat Advanced Debt Collection delivers a cloud-based solution custom-built for collection agencies since 2002.

Lariat Advanced Debt Collection Key Features

Lariat simplifies the collection process with these practical tools:

- Track multiple debts owned by multiple clients for a single debtor

- Up-to-the-minute messaging system and event notifications for payment reminders

- The ability to perform mass updates using query and update functions

- Writing a custom letter according to business needs

- Global theme, security, and report configuration parameters

Customers can create accounts, generate reports, keep an eye on collection activities, and get in touch with the agency directly through the system’s client portal.

Lariat Advanced Debt Collection AI Capabilities

Lariat seamlessly integrates intelligent features into its collection workflow:

The notification system sends automatic reminders to clients about pending payments.

Advanced search functions help users locate debtors anywhere in the system. The platform connects with merchant processors like Authorize.net and USAePay for payment processing.

Lariat Advanced Debt Collection Best Use Case

Lariat proves most effective for:

- Commercial collection agencies managing portfolios in various industries

- Healthcare providers handling patient billing

- Debt purchasers requiring portfolio management

- Retail establishments with departments dedicated to accounts receivable

The platform excels when businesses need detailed AI debt collection software with client communication tools.

SimpleDebt

SimpleDebt takes a different approach by focusing on debt relief solutions if you have financial burdens.

SimpleDebt Key Features

SimpleDebt excels with these practical debt management features:

- A financial review process analyzes the debt-to-income ratio at no cost

- Two solution paths: debt settlements and loan options

- Monthly deposits into dedicated accounts for settlements

- Frequent updates on your debt resolution progress

- Regular progress updates as you resolve your debt

Users can easily track debts with the help of the mobile app. You will no longer require paper records or mental notes. Debtor names, debt amounts, currencies, dates, and comments are the most important elements displayed in this straightforward design.

SimpleDebt AI Capabilities

SimpleDebt uses automation to handle monthly deposits and track payment progress. The system watches upcoming payments and flags missed ones quickly.

The platform’s automated debt management tools help users take back financial control. This approach makes debt management easier through well-laid-out plans.

SimpleDebt Best Use Case

SimpleDebt works best for:

- Users with unsecured debts like credit cards, personal loans, and medical bills

- People looking for alternatives to bankruptcy

- Users who need a simple system to track multiple debts

The fees range from 15%-25% of enrolled debt. A $10,000 USD debt settlement would cost $1,500 USD – $2,500 USD in fees. The company’s ratings remain high: 4.9/5 on Trustpilot and 4.2/5 with BBB.

Final Words:

Data-driven decisions that scale are a common theme among the tools discussed. Some place a strong emphasis on open APIs and end-to-end processes. Others concentrate on legal workflows, AR automation, or digital self-service.

Adapt capabilities to your channel strategy, compliance requirements, and portfolio mix. Give top priority to information centralization, repetitive task automation, and transparent reporting systems. Strong fit shows up in faster adjustments, higher right-party contacts, and fewer manual steps.

If your roadmap calls for AI-guided treatments, omnichannel outreach, and measurable outcomes, the options here provide a practical path. Select the combination that aligns with your goals and supports steady, compliant recovery.

Frequently Asked Questions

How is AI used in the debt recovery industry?

Will AI replace accountants by 2030?

No, it won’t, but it will redefine some repetitive tasks with smart approaches.

Do the Big 4 accounting firms use AI?

Yes, they do, and also heavily invest in them.

Display fonts transform ordinary designs into extraordinary visual experiences. These expressive typefaces capture attention and convey personality. TypeType specializes in…

Hassling on the web to figure out how to recover unsaved PowerPoint documents? Now, just relax and follow this guide;…

Online learning has become a normal part of education today. Students attend online classes, take tests on the internet, and…

Someone recently emailed me and asked: Can my Mac recover overwritten files? But replying to an email was not enough…

Accidentally emptied the Trash on your Mac and now need those files back? Most users assume everything is gone (just…

As we all know that customer support operations serve as the essential foundation of any enterprise. Satisfied customers demonstrate loyalty,…

User engagement is now one of the best signs of how well a website performs, affecting search rankings, sales, and…

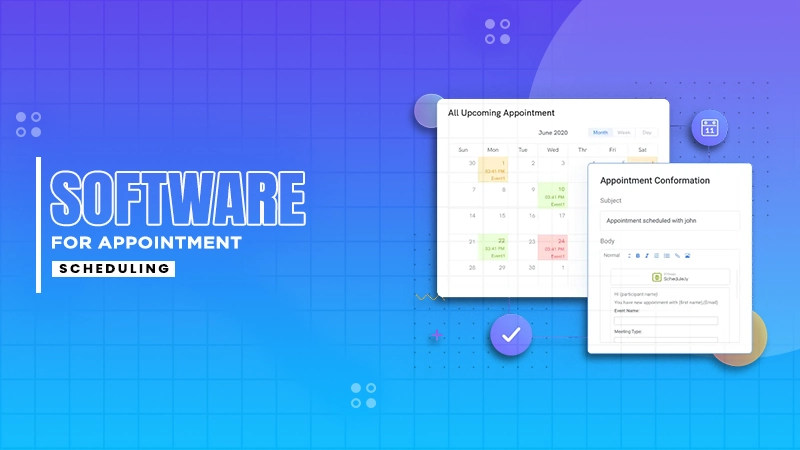

Managing queues and appointments manually creates bottlenecks, angry customers, and burned-out staff. Growing businesses need smarter systems handling bookings, walk-ins,…

Ready to see how broadcasters are serving up killer content? Broadcasting has come a long way since its early days.…