How Payroll Services Help Small Businesses Stay IRS-Compliant

IRS can be quite brutal if their regulatory compliance is not met. They have proper laws for everyone and if they are not follower there will be penalties and legal action will be taken which wouldn’t end in a good way.

Small businesses often struggle with paying their employees on time, which can be frustrating, and this is where payroll services come to their rescue. According to Indeed, “A payroll service is a third-party company or organization that assists with payroll processing.”

So, with that being said, in this article, I’ll mention how payroll services help small businesses stay compliant with IRS guidelines.

Accurate Wage Calculation

One of the key features of a payroll service is accurate employee wage calculation. It is determined by calculating hours worked, salary rates, leave taken, paid leave given. And any other additional earnings like bonus or overtime.

It is done not only because employees deserve fair payroll, but also because it comes under IRS guidelines. If it’s not done correctly, there will be errors while filing for taxes, exposing businesses to penalties and fines from the IRS.

However, since it is done by professionals, companies can rest assured because these third-party services maintain compliance and foster trust within their workforce. Accurate calculation helps businesses manage labor costs effectively.

Timely Tax Withholdings and Filing

Filing and Withholdings tax on time is a crucial aspect that cant be avoided. It includes accurate amounts of federal, state, and local taxes that need to be deducted from the employee wages.

These taxes that are taken from employees need to be deposited to the authorities too on time because there are various rules and deadlines related to it, if they are not followed penalties will be applicable.

But, with payroll service by your side, there is no need to worry, as they already carry deep understanding of the situation and make sure to file them. This way, the company’s financial health is maintained, and they don’t get in legal trouble.

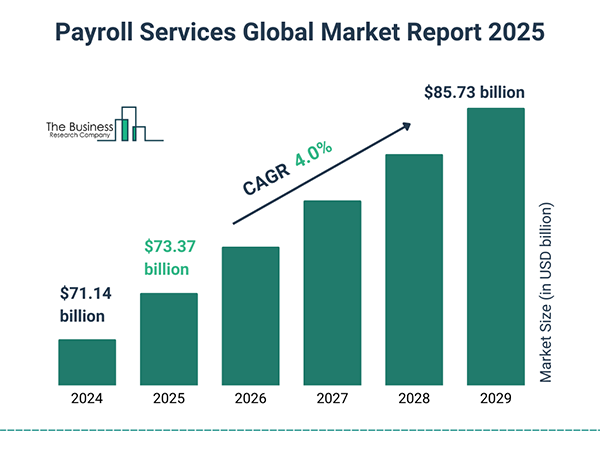

These kinds of services are in demand right now and in 2024 payroll service market was valued at $71.14 billion. In the infographic, you can track its progress and see that it’s only going to reach greater heights.

Navigating Complex Tax Laws

Let’s be honest, we can’t possibly know about all the laws and stay compliant. Why? Because they keep getting updated and new guidelines are introduced. Small business owners already have things to take care of, which makes it challenging for them to keep tabs on updates.

That’s why it becomes crucial for them to hire experts who can do this task and maintain the integrity of the firm. Professional carry knowledge on how tax laws work and how it is affected along with compliance obligations. For companies seeking to hire international talent, global payroll services simplify the process by eliminating the need to establish local entities for tax and compliance purposes.

Organizations are able to dodge costly errors and allocate resources more effectively. With this being out from concerns, owners can do what they do best.

Comprehensive Record Keeping and Reporting

IRS has strictly mentioned this in their guidelines that every corporation has to generate reports and maintain meticulous records. Payroll services streamline this process and keeps every detail whether its employee wage or tax withholding are documented accordingly.

But when does this help? During the audit process, it benefits greatly and businesses are able to corporate with tax authorities. IRS compliant reports and forms like W-2 and 1099 forms are prepared by payroll process.

Staying Ahead of Regulatory Changes

Keeping up with regulatory changes in payroll and tax legislation is a continuous challenge for small businesses. But if someone fails to keep up with these changes, it can result in serious compliance issues.

Payroll services keep tabs on the latest and updates laws so that they can adapt to new payroll process without messing up, cooperating with compliance. This might look like a small feature, but because of it businesses will never be blind sided by regulatory shifts, and it also minimizes the risk of legal penalties.

Time Efficiency and Business Focus

Time and resource savings are quite crucial for small businesses, and payroll services significantly contribute to it. They handle time-consuming tasks like wage calculation, report generation, and tax withholding/ filing.

Since professionals are handling it, business owners can use the time saved on other operations, they also have greater manpower which can be used on higher priorities. Officials can also come up with new solutions for customer engagement and expansion.

DID YOU KNOW?If employers fail to pay the payroll tax penalties after being late with filing taxes, it would be increased. If it’s 1 to 5 days late, there would be a 2% penalty, and 10% if 16+ days past due!

Conclusion

Payroll services are the perfect solution for small business owners, and they help them in numerous ways. Whether it’s filing tax withholdings on time or staying compliant with tax laws, it does everything effectively.

They stay updated with the IRS and ensure that all the legal standards are met, so the business can avoid any kind of penalties or get in legal trouble. It’s a great investment and business executives can focus on other things like making new strategies and core operations.

Most people think hackers need advanced tools to find security gaps. Sorry to break the news, but sometimes, Google is…

If you are a part of any business, you might have attended meetings. And in case you were connected to…

SSD data recovery software can retrieve data that has been deleted, damaged, or otherwise rendered inaccessible from the SSD hard…

How can I improve the performance and grow my business? My team is already occupied with several projects, how do…

It feels very frustrating to lose all your digital data due to just one panic mistake of selecting a password…

Special Purpose Vehicles (SPVs) are a type of legally structured company. They are created by parent companies, usually with temporary…

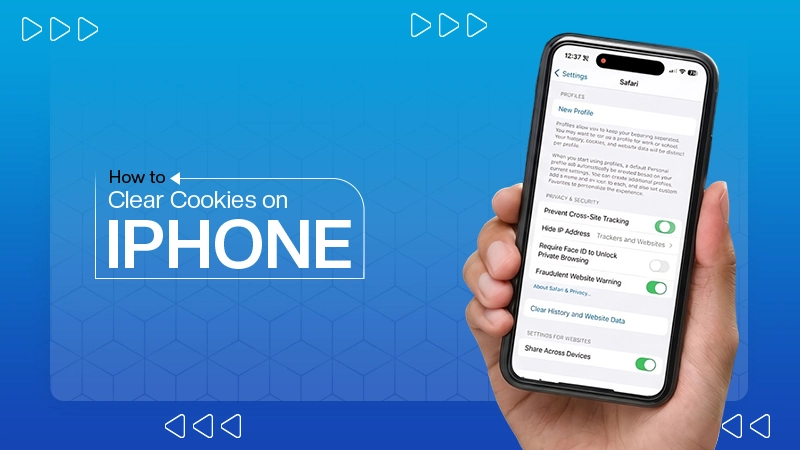

Web cache and cookies make browsing faster by saving logins, settings, and site data. But over time, they can slow…

Finding the best tools for your company feels like a big job. You need systems that actually help your team…

In the digital age, instant messaging apps have become an essential part of our daily communication. Whether for personal use,…