Because financial data is always valuable and always targeted. Continuous monitoring helps detect threats early, before they turn into costly breaches or public trust issues.

Security Monitoring for Financial Data Assets: Best Practices and Solutions

- The Growing Importance of Monitoring Financial Data Assets

- Key Threats Targeting Financial Data in Digital Environments

- Best Practices for Security Monitoring of Financial Data

- Continuous Monitoring

- Real-Time Alerts

- Risk Prioritization

- Solutions Used for Financial Data Monitoring

- Integrating Security Monitoring With Data Resilience Strategies

- Conclusion

- Frequently Asked Questions

Financial data is not just numbers sitting quietly in a database like it once used to be; it is now moving, syncing, updating, and being accessed every second across cloud platforms, apps, APIs, and remote systems. This makes it a golden target in the eyes of an attacker.

In fact, IBM’s Cost of a Data Breach Report consistently shows that breaches involving financial data are among the most expensive, with the average breach cost running into millions of dollars, not counting the long-term loss of customer trust. That’s the scary part.

The hopeful part? Most of these incidents could be detected earlier, or even prevented through strong security monitoring. Organizations must understand that security monitoring has shifted from a “nice to have” to a “must-have” policy. Let’s learn how it spots the smallest of warnings beforehand to prevent full-blown crises.

Key Takeaways

- Continuous security monitoring is essential for protecting financial data assets from constantly evolving cyber threats.

- Real-time alerts and risk-based prioritization allow teams to respond faster, reducing financial loss and regulatory exposure.

- Security monitoring works best when integrated with data resilience, ensuring systems remain available and recoverable during incidents.

- Visibility across users, systems, and data flows helps uncover insider threats and misconfigurations before damage occurs.

- Strong monitoring isn’t just about security; it directly supports compliance, uptime, and customer trust.

The Growing Importance of Monitoring Financial Data Assets

Digital banking, fintech platforms, remote access, and real-time payment systems are all making financial data environments grow quickly. This growth makes the attack surface bigger, so its important to always be able to see what’s going on in systems. Security monitoring helps businesses keep an eye on who is accessing their data, find problems, and spot strange behavior before it causes damage.

FFIEC regulatory requirements make this need even stronger. To avoid fines and meet compliance standards, financial institutions must show that they are always keeping an eye on sensitive data. In addition to compliance, proactive monitoring helps businesses avoid downtime, fraud, and data loss, which can quickly ruin services and make customers lose trust.

Key Threats Targeting Financial Data in Digital Environments

As shown in the infographic above, financial data is always at risk, and the threats are always changing. Cybercriminals want this data because it is worth money and can be sold again. Ransomware attacks that encrypt important systems, phishing campaigns that steal login information, and insider threats where authorized users misuse access are all common threats.

Advanced persistent threats (APTs) are also a long-term threat because they watch systems and steal data over time without anyone knowing. Cloud environments that aren’t set up correctly, APIs that aren’t secure, and integrations with third parties all make things even more dangerous. These threats can go undetected until they have already caused a lot of damage if they are not constantly watched.

Best Practices for Security Monitoring of Financial Data

Enhancing banking cybersecurity against ransomware threats is crucial. Security monitoring is one of the aspects in financial data that should not go unnoticed. Here is how you can take care of that:

Continuous Monitoring

The security of financial data depends on constant monitoring. Instead of relying on audits every now and then, businesses need to keep an eye on their systems, networks, and users all the time. This method lets you see data flows, access patterns, and infrastructure performance in real time.

Real-Time Alerts

Alerts in real time let security teams act right away when they see something suspicious. Automated alerts can let you know about strange login attempts, unauthorised access to data, unusual transaction volumes, or changes to the system’s configuration.

Risk Prioritization

Some alerts are riskier than others. Risk prioritization is an important part of effective security monitoring because it helps you focus on the most serious threats. Financial data environments produce huge amounts of security data, so it’s important to set priorities.

PRO TIP

Many financial breaches don’t start with sophisticated hacks; they start with perfectly valid credentials. Monitoring unusual behavior (like access at odd hours or sudden spikes in data activity) often catches attackers even when passwords aren’t compromised.

Solutions Used for Financial Data Monitoring

To keep an eye on their financial data assets, organizations need a mix of advanced tools. Security information and Event Management (SIEM) platforms gather and connect logs from different systems so that you can see everything in one place. User and Entity Behaviour Analytics (UEBA) tools find strange patterns that could mean insider threats or hacked accounts.

Cloud security posture management (CSPM) tools helps keep an eye on cloud-based financial data environments to make sure they are set up correctly and are in line with regulations. EDR (endpoint detection and response) solutions keep an eye on what users and servers are doing, adding another level of security.

These solutions work together to help find, investigate, and respond to threats before they happen in complex financial ecosystems.

Integrating Security Monitoring With Data Resilience Strategies

When combined with other strategies for data resilience, security monitoring works best. Monitoring finds problems and threats, while data resilience makes sure that systems can quickly recover without losing any data.

Organizations can reduce downtime and costs by using monitoring, secure backups, disaster recovery planning, and failover systems all at the same time. Alerts from monitoring can cause automatic actions like isolating affected systems or starting recovery workflows. This integration makes sure that financial operations are always available, even when there are cyber incidents or system failures.

Conclusion

Security monitoring is an important part of keeping financial data safe. Organizations need to stop using reactive security measures as threats get more complex and financial systems become more connected.

Businesses can protect sensitive financial data, stay in compliance, and keep customer trust by using continuous monitoring, real-time alerts, and risk-based prioritization, and by combining these with data resilience strategies.

Frequently Asked Questions

Why is security monitoring so critical for financial data?

Can security monitoring really stop breaches, or does it just report them?

It does both. While it can’t stop every attack on its own, early detection dramatically limits damage, reduces downtime, and speeds up recovery.

Is security monitoring only important for big banks?

Not at all. Fintech startups, payment platforms, and even mid-sized businesses handling financial data are prime targets; sometimes because they have fewer defenses.

How often should financial systems be monitored?

Honestly? All the time. Financial data moves 24/7, so monitoring needs to eb continuous, not limited to periodic checks or audits.

Most people think hackers need advanced tools to find security gaps. Sorry to break the news, but sometimes, Google is…

If you are a part of any business, you might have attended meetings. And in case you were connected to…

SSD data recovery software can retrieve data that has been deleted, damaged, or otherwise rendered inaccessible from the SSD hard…

How can I improve the performance and grow my business? My team is already occupied with several projects, how do…

It feels very frustrating to lose all your digital data due to just one panic mistake of selecting a password…

Special Purpose Vehicles (SPVs) are a type of legally structured company. They are created by parent companies, usually with temporary…

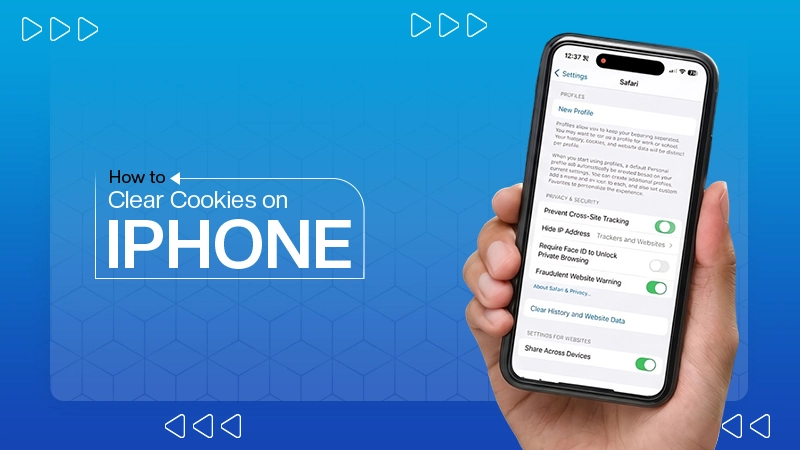

Web cache and cookies make browsing faster by saving logins, settings, and site data. But over time, they can slow…

Finding the best tools for your company feels like a big job. You need systems that actually help your team…

In the digital age, instant messaging apps have become an essential part of our daily communication. Whether for personal use,…