The wealth management platform market is projected to grow from USD 4.0 billion in 2025 to USD 10.4 billion by 2035, at a CAGR of 10.0%.

Software Wealth Management: Building a Unified, Scalable, and Strategic Operating Model

- The Changing Landscape of Wealth Management Operations

- Wealth Management Software Platform: Creating a Single Source of Truth

- Simplifying Complexity Through Integration

- Portfolio Management as an Operational Core

- Reporting and Regulatory Readiness

- Wealth Management Digital Software: Supporting Digital-First Client Engagement

- Automation as a Driver of Operational Efficiency

- Data Aggregation Across Custodians and Asset Classes

- Security and Governance as Structural Priorities

- Scalability as an Operational Requirement

- The Strategic Value of Software Wealth Management

- Frequently Asked Questions

The evolution of financial services has altered how firms approach portfolio management, compliance, and client engagement. As regulatory requirements expand, client expectations rise, and asset structures become more complex, traditional systems no longer provide the operational clarity required to scale effectively.

In this environment, wealth management software has evolved from a supporting tool to a strategic foundation. Modern platforms such as https://www.performativ.com/features demonstrate how integrated technology can unify workflows, enhance transparency, and support long-term operational resilience.

Today’s wealth management firms face pressures that go far beyond performance tracking. This blog post covers how this transformation is supported by software wealth management, which aligns technology with strategic objectives and ensures that growth does not compromise governance, accuracy, or client trust.

Key Takeaways

- Understanding everything about wealth management software

- Decoding ways to simplify complexity

- Uncovering its impact on the client engagement

- Discovering data aggregation across custodians

- Looking at the strategic value of operational value

The Changing Landscape of Wealth Management Operations

Over the past decade, wealth management has become more structurally complex. Clients have multiple custodians, alternative investments are becoming more common, and regulatory oversight is expanding. At the same time, clients expect immediate access to transparent, accurate information delivered through modern digital channels.

Legacy infrastructures struggle to support this environment. Data often lives in separate systems that require manual reconciliation. Reporting workflows depend on static processes that are difficult to update as regulations change. Compliance teams operate independently from portfolio managers, creating inefficiencies and communication gaps.

Software wealth management addresses these challenges by providing a unified environment where data, workflows, and reporting structures coexist. Instead of managing multiple systems, firms can rely on a single operational framework that supports portfolio oversight, compliance, and client communication simultaneously.

This integration allows firms to move away from reactive operations and toward proactive management models built on accuracy, consistency, and scalability.

Wealth Management Software Platform: Creating a Single Source of Truth

A core objective of any modern wealth management operation is the creation of a single, reliable source of truth. A wealth management software platform centralizes portfolio data, client information, transaction records, and compliance documentation into one cohesive structure.

By unifying information across departments and functions, firms gain:

- Consistent portfolio and client data across the organization

- Reduced dependency on manual reconciliation

- Improved data accuracy and audit readiness

- Faster decision-making through real-time visibility

- Greater alignment between investment, compliance, and reporting teams

A centralized platform removes ambiguity. When every stakeholder works from the same dataset, communication becomes more effective and operational risk is reduced. This unified foundation enables businesses to grow while maintaining control over data quality and regulatory responsibilities.

A wealth management software platform also streamlines onboarding processes by incorporating client documentation, risk profiling, and portfolio setup into structured workflows. This consistency ensures that new clients and assets are incorporated efficiently while maintaining compliance standards.

Interesting Facts

By 2025, global assets under management are predicted to reach $145.4 trillion, necessitating advanced software for management.

Simplifying Complexity Through Integration

Wealth management firms operate at the intersection of investment strategy, compliance, and client relationships. Each area introduces its own complexity. Without integration, these functions become siloed, increasing operational friction.

Software wealth management supports integration by connecting:

- Portfolio management tools

- Compliance monitoring systems

- Reporting engines

- Client communication channels

- Custodian and broker data feeds

This connectivity ensures that changes in one area automatically reflect across the entire system. When a portfolio is adjusted, reports update accordingly. When compliance thresholds are triggered, alerts are generated. When market values shift, client dashboards reflect those changes in real time.

Integration transforms complexity into structured, manageable workflows that scale alongside the organization.

Portfolio Management as an Operational Core

Effective portfolio oversight remains central to wealth management operations. Software wealth management platforms support portfolio management through consolidated views across asset classes, custodians, and investment strategies.

Key portfolio capabilities typically include:

- Aggregated portfolio views across public and private assets

- Performance measurement and benchmarking

- Risk exposure monitoring

- Rebalancing and order management

- Liquidity and cash flow forecasting

These functions allow advisors and portfolio managers to move beyond static reporting and toward dynamic, insight-driven decision-making. Rather than reacting to past performance, professionals can assess current risks and adjust strategies in real time.

By embedding these tools into a unified platform, firms maintain operational consistency while enhancing strategic oversight.

Reporting and Regulatory Readiness

Reporting and compliance remain among the most resource-intensive components of wealth management. Manual report generation introduces delays and increases the risk of inconsistencies. Regulatory frameworks continue to evolve, requiring adaptable reporting structures and reliable audit trails.

A wealth management software platform streamlines reporting through:

- Automated report generation

- Customizable report templates

- Centralized compliance documentation

- Immutable audit logs

- Consistent data formatting

This structure enables firms to respond quickly to regulatory requests while maintaining transparency for clients. Compliance becomes an integrated process rather than an isolated operational burden.

By embedding compliance into everyday workflows, software wealth management ensures that governance supports business growth instead of limiting it.

Wealth Management Digital Software: Supporting Digital-First Client Engagement

Client expectations have shifted decisively toward digital-first experiences. Transparency, accessibility, and immediacy are no longer optional features. Wealth management digital software enables firms to deliver professional, secure, and consistent digital interactions.

Digital platforms typically support:

- Secure client portals

- Real-time portfolio visibility

- On-demand report access

- Branded client interfaces

- Integrated communication channels

These tools strengthen trust by ensuring clients always have access to accurate and up-to-date information. Digital engagement also improves internal efficiency by reducing manual communication and administrative tasks.

Wealth management digital software aligns operational transparency with modern service expectations, reinforcing credibility while improving client satisfaction.

Automation as a Driver of Operational Efficiency

As firms grow, manual workflows become increasingly difficult to maintain. Automation is essential for maintaining efficiency while expanding operations.

Software wealth management platforms support automation through:

- Rule-based portfolio rebalancing

- Compliance monitoring alerts

- Automated onboarding workflows

- Scheduled reporting processes

- Data validation checks

Automation reduces human error, standardizes procedures, and frees teams to focus on higher-value responsibilities such as strategic planning and client advisory services. Operational consistency becomes a built-in feature rather than a manual effort.

Data Aggregation Across Custodians and Asset Classes

Clients often hold assets across multiple custodians, investment vehicles, and jurisdictions. Without effective aggregation, portfolio oversight becomes fragmented.

A wealth management software platform enables:

- Automated synchronization with custodians and brokers

- Support for diverse asset classes, including alternatives

- Manual data entry for specialized assets

- Unified portfolio valuation structures

This aggregation ensures advisors and managers maintain complete visibility regardless of where assets are held. Accurate, consolidated data supports better decision-making and stronger client relationships.

Security and Governance as Structural Priorities

Wealth management firms handle highly sensitive financial data. Security and governance must therefore be embedded into every operational layer.

Software wealth management platforms typically support:

- Advanced encryption standards

- Role-based access controls

- Secure authentication protocols

- Centralized activity logging

- Regulatory compliance alignment

These safeguards protect both client information and institutional integrity. By integrating security into platform architecture, firms reduce exposure to operational and reputational risks.

Scalability as an Operational Requirement

Growth introduces complexity. Without scalable infrastructure, expanding client bases and asset volumes strain operational systems.

A wealth management software platform supports scalability by:

- Managing higher data volumes without performance loss

- Maintaining consistent workflows as teams expand

- Supporting regulatory compliance across jurisdictions

- Enabling new service models without disruption

Scalability ensures that growth remains sustainable rather than disruptive.

The Strategic Value of Software Wealth Management

Software wealth management represents more than technological modernization. It defines how firms structure operations, manage risk, and deliver value.

By unifying data, automating workflows, and supporting digital engagement, modern platforms transform complexity into operational clarity. They allow businesses to scale confidently, comply consistently, and serve customers transparently.

A strong wealth management software platform acts as the strategic foundation of modern financial institutions. It supports resilience, governance, and long-term sustainability in an increasingly complex and regulated environment.

As the industry continues to evolve, software wealth management will remain central to how firms adapt, compete, and grow.

Frequently Asked Questions

How big is the wealth management platform market?

What is interesting about wealth management?

It is a personalized service where we work with you to plan, grow, and protect your wealth for the future.

What are the 4 pillars of wealth?

Acquire, Protect, Grow, and Pass it Along.

Most people think hackers need advanced tools to find security gaps. Sorry to break the news, but sometimes, Google is…

If you are a part of any business, you might have attended meetings. And in case you were connected to…

SSD data recovery software can retrieve data that has been deleted, damaged, or otherwise rendered inaccessible from the SSD hard…

How can I improve the performance and grow my business? My team is already occupied with several projects, how do…

It feels very frustrating to lose all your digital data due to just one panic mistake of selecting a password…

Special Purpose Vehicles (SPVs) are a type of legally structured company. They are created by parent companies, usually with temporary…

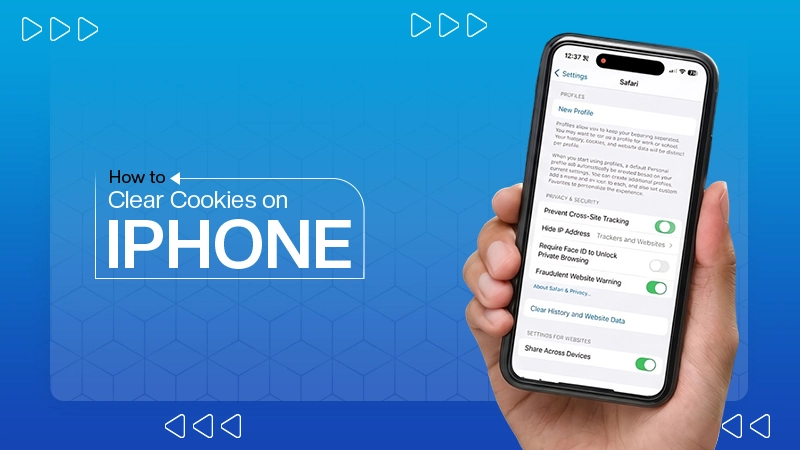

Web cache and cookies make browsing faster by saving logins, settings, and site data. But over time, they can slow…

Finding the best tools for your company feels like a big job. You need systems that actually help your team…

In the digital age, instant messaging apps have become an essential part of our daily communication. Whether for personal use,…