Streamlining Payroll Processes for Accountants Using Technology

Tired of burning hours on payroll each week?

As an accountant you are well aware of the time consumption of processing payroll. The time that could be better spent doing more profitable client work. And as if that wasn’t bad enough…

Manual payroll practices are hemorrhaging firms money.

The bright side?

Accounting and payroll technology have completely changed the payroll game for good. Software solutions automate the boring stuff and remove the human error from the payroll process.

Here’s what’s in store:

- Why Payroll Tech for Accountants is Non-Negotiable

- Hidden Expenses of Manual Payroll Processing

- Must Have Features That Save Time

- Tips for Evaluating Options

- Implementation Tips for Successful Software Migration

Why Payroll Tech for Accountants is Non-Negotiable

Payroll software is no longer just a “nice to have”.

In fact, it’s fast becoming a “must have” to remain competitive in the accounting industry. The numbers speak for themselves.

Firms that fail to embrace technology and remain mired in the past fall behind a little bit more each day. At the same time, progressive accounting firms are using software to manage more clients with less work.

Don’t believe us?

Take a look at some hard numbers. A good accountants payroll software solution can reduce processing time by a few hours each week. Compare this to the pricing for accountant Payroll software, and the investment is quickly recouped through time savings and penalty avoidance alone.

According to recent data, 51% of organizations still use spreadsheets and manual processes to create payroll reports. That’s almost 3/5ths of the market still doing it the old way.

Wow, it makes you wonder why they would do that?

Here’s why:

Manual payroll processing is inherently prone to error. Errors result in penalties. Penalties cost money and alienate clients.

The IRS estimates that an eye-watering 33% of employers make payroll errors that are collectively responsible for billions in annual costs to employers. For accountants that manage payroll for multiple clients, those mistakes and penalties are compounded with every new client added.

But here’s the silver lining…

Payroll technology not only helps prevent errors, but it also creates more time for advisory services that yield higher fees. If payroll can be set and forgotten by accountants, they can focus on what they do best.

Hidden Expenses of Manual Payroll Processing

Thinking manual payroll is a cost savings?

You’d be wrong.

The hidden costs of doing things the old way start to add up quickly. What’s more is that most accounting firms don’t even realize what they are missing out on.

The costs of manual payroll processes include:

- Staff time and salaries dedicated to data entry, calculations, and follow-up.

- Error correction and data re-processing.

- IRS penalties from incorrect or late filings.

- Client churn due to client employee mistakes.

- Missed deadlines and late fees.

Small to mid-sized businesses suffer an average of $845 in IRS penalties per event. When an accountant makes these mistakes on behalf of a client, trust and reputation are at risk.

And here’s something you may not have thought about…

Two payroll mistakes are all it takes to make 50% of employees look for new employment. When your clients’ employees see errors in their pay, they are not the ones going to stay.

The time costs are just as brutal. Business owners spend nearly five hours on payroll processing alone each pay period. Accountants serving multiple clients multiply that time across every client they service.

No bueno.

Must Have Features That Save Time

Payroll software packages are not all created equal.

The best solutions for accountants include must-have features that make it easier to handle multiple clients at the same time. These are the difference between ok software and life-changing tools.

Here’s what to look for:

- Multi-client dashboards for simplified account management.

- Tax calculation automation and electronic filing.

- Direct deposit processing.

- Year-end form generation such as W-2s and 1099s.

- Easy integration to accounting software solutions.

- Automatic tax compliance updates.

Cloud-based solutions have become the standard in the industry for a good reason. Real-time access from any location and automatic software updates when tax laws change are huge advantages. No more manual patches or out-of-date tax tables.

Don’t forget about integration…

If the payroll software can talk to an accounting software solution directly, the bulk of data entry happens automatically. No need to export or import data files. No more reconciliation headaches to keep manual processes all in sync.

Tips for Evaluating Options

Choosing payroll software is a daunting task.

It seems like every software company is in the payroll business now. There are dozens of options to choose from, and each one has claims of being the best accounting software out there. Here’s the thing…

The right choice is different for every firm.

Start with these questions before you commit to a vendor.

- How many clients will be on the system?

- What level of vendor support will be available?

- Can it easily integrate with current accounting solutions?

- How difficult is the learning curve for staff?

- How does pricing scale as the firm grows?

Don’t just look at the cost. Yes, that’s important but how much hidden cost will a cheap system create in additional work for staff? Look for a balance between affordability and features.

Security is a must-have.

Payroll data includes the most sensitive personal information. Social Security numbers and bank accounts are just the beginning. Enterprise security is a non-negotiable feature of any payroll software.

Look at the vendor’s history as well. How long have they been in business? What do other accountants have to say about their experience with the software? Online reviews and forums can help shed some light.

Implementation Tips for Successful Software Migration

Buying the software is just the start.

Implementation is where too many firms fail. Not because they chose a bad software solution, but because they did not take the time to roll it out correctly.

Here’s our recommended approach.

- Begin by rolling out to a test group of clients.

- Train all staff members before launch.

- Establish standard operating procedures.

- Allow time for questions and problems.

- Build in ample time for the whole project.

Don’t try to switch every client at once. Begin with a test group of accounts. Get the bugs worked out before expanding to the full client list.

The same goes for staff training. Staff that are not properly trained will use the software incorrectly. Create errors and frustration. Invest in training from the get-go to avoid problems down the road.

Don’t forget the clients either. Communicate in advance about the pending change. Be sure to focus on the benefits they will receive from the system. Build expectation of any small disruption during the conversion.

Wrapping It Up

Streamlining the payroll process through technology is no longer an option.

It’s a “must do” if an accounting firm wants to remain competitive and grow. The benefits are indisputable and measurable.

Let’s quickly recap:

- Manual payroll is time-consuming and error-prone

- Modern software automates calculations, re-occurs and electronic filings.

- Seamless integration eliminates duplicate data entry.

- Cloud-based solutions are flexible and secure.

- Proper implementation is critical to long-term success.

The firms that move quickly to adopt payroll technology are the ones that will thrive. Those that cling to spreadsheets and manual processes will lag behind. The choice is yours.

Begin evaluating options today. The sooner the change is made, the sooner the benefits kick in. Happy clients, happy staff, and a happy bottom line.

There you have it.

The power of the right payroll technology for accountants.

Most people think hackers need advanced tools to find security gaps. Sorry to break the news, but sometimes, Google is…

If you are a part of any business, you might have attended meetings. And in case you were connected to…

SSD data recovery software can retrieve data that has been deleted, damaged, or otherwise rendered inaccessible from the SSD hard…

How can I improve the performance and grow my business? My team is already occupied with several projects, how do…

It feels very frustrating to lose all your digital data due to just one panic mistake of selecting a password…

Special Purpose Vehicles (SPVs) are a type of legally structured company. They are created by parent companies, usually with temporary…

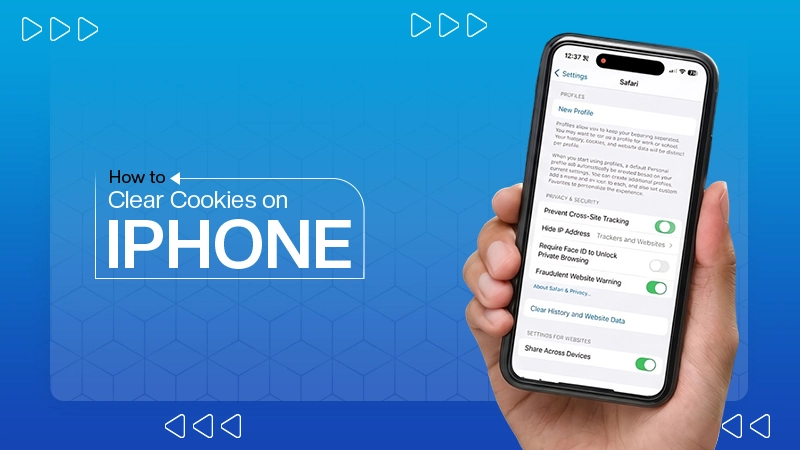

Web cache and cookies make browsing faster by saving logins, settings, and site data. But over time, they can slow…

Finding the best tools for your company feels like a big job. You need systems that actually help your team…

In the digital age, instant messaging apps have become an essential part of our daily communication. Whether for personal use,…